- SUI sits at ~$3.40 with strong DeFi/NFT growth, still ~40% under its ATH — room to run as the ecosystem scales.

- WAL aims to rival Filecoin, already 26% utilized — hit $0.76 ATH, now $0.51 with fresh partnerships.

- SEND leads in SUI-based DeFi lending, zero borrowing fees, huge BTC inflows — trading far below highs.

The Sui blockchain’s been gaining traction lately, and some of the projects built on top of it? Well, they’re starting to show signs of real breakout potential. With solid dev activity and more users jumping in, a few of these SUI-linked altcoins could be setting up for serious runs — maybe even 10x, if the market flips bullish again. Let’s dive into three that stand out right now.

SUI (SUI) — The Core of the Ecosystem

First up is the network’s own token — SUI. It’s only been around for a couple years, but it’s already made waves. The team keeps stacking features, especially around DeFi and NFTs. One of the newer additions, Nautilus, aims to bring private and tamper-proof oracles into the mix — not bad for a project still finding its groove.

At the moment, SUI holds the 8th spot in terms of TVL across all blockchains. Priced at around $3.40, it’s still sitting roughly 40% below its all-time high. Some folks see this as a solid entry point, especially with the ecosystem expanding. Could it climb from here? A lot of people seem to think so.

Walrus Protocol (WAL) — Storage Gets a Boost

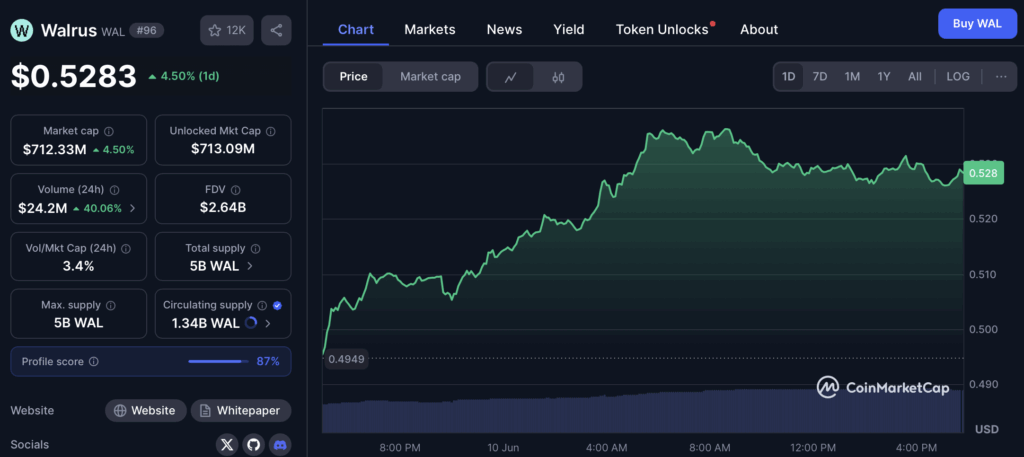

Next on the radar is Walrus Protocol — WAL. This one’s all about decentralized storage, aiming to do what Filecoin does but with fewer hiccups and better speed. It raised a hefty $140 million and launched its mainnet in March. Adoption’s been solid, with over 26% of available storage already in use. It also teamed up with Nautilus for added privacy and data encryption — another win.

Price-wise, WAL hit an all-time high at $0.76 recently but has since cooled off to about $0.51. Still up on the day though. If the partnerships keep rolling and users keep coming, the idea of a 10x isn’t too far-fetched.

Suilend (SEND) — DeFi’s Lending Leader

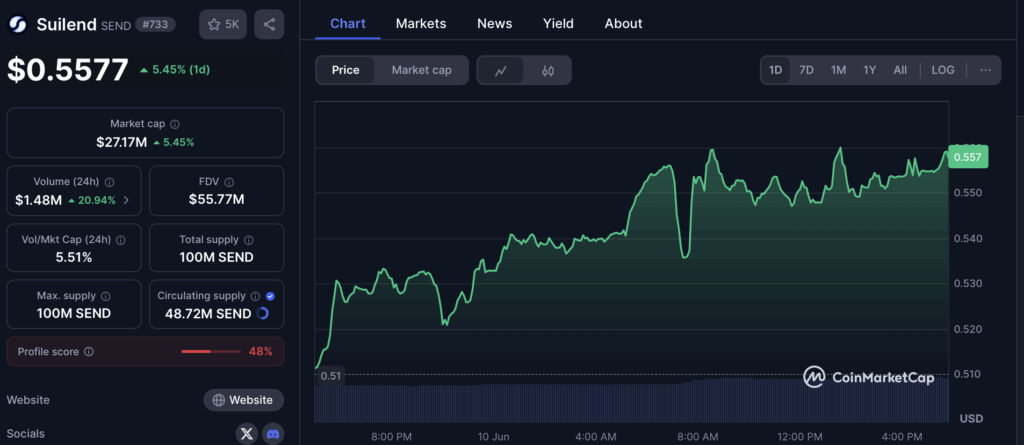

Last but not least, there’s SEND — the top lending and borrowing protocol in the SUI ecosystem. It’s got the highest TVL in DeFi on the chain and recently added zero borrowing fees, which… let’s be honest, is kind of a game-changer. APYs on some assets are wild — we’re talking 42% on DEEP and 64% on WPLUS.

With over $100 million in Bitcoin-backed assets already deposited, it’s leading the pack in that corner of DeFi. Right now, the SEND token trades at $0.53 — well under previous highs, and yeah, that might be a window of opportunity for early movers.